The treasurer has now registered a Legislative Instrument link, accompanied by an Explanatory Statement which amends the existing JobKeeper scheme.

These changes will seek to make the scheme more targeted and in our opinion, will significantly reduce the number of businesses that are eligible to receive the payments from 28 September 2020 onwards.

The amendments will give effect to the following changes being consistent with announcements made on 21 July 2020 and 7 August 2020.

A summary of the key changes to the scheme is as follows;

- Two extensions to the JobKeeper scheme beyond the former end date of 27 September 2020;

- A two-tiered payment rate system;

- Eligibility rules for the two payment tiers based on the number of hours worked during the reference period; and

- A requirement to re-test a business’s eligibility each quarter based on a new “actual decline in turnover test”

Further detail with regards to the changes to the scheme are outlined below.

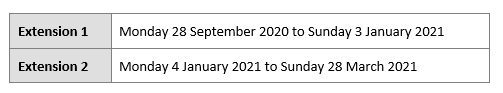

Extension Dates

There will be two extensions to the original JobKeeper scheme which was originally scheduled to end on 27 September 2020. The extensions to the scheme will be two-tiered in accordance with the following dates:

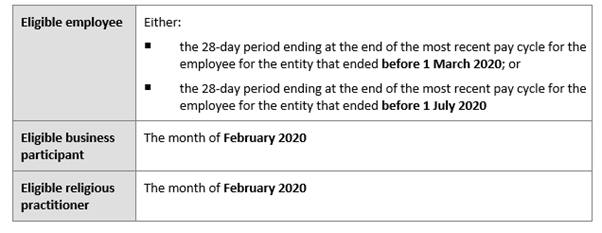

The reference period

This will determine how much to pay each eligible employee by determining how many hours the employee worked in their applicable “reference period”.

The reference period for an individual is determined as follows:

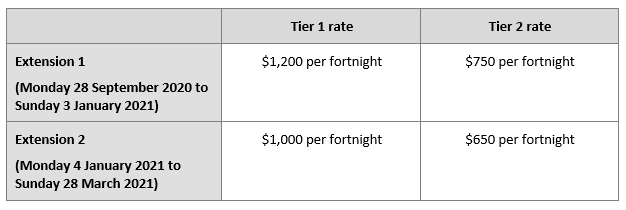

Payment rates

From 28 September 2020, the payment rates will be split into a Tier 1 rate (i.e. the higher rate) and a Tier 2 rate (i.e. the lower rate). Further, both Tier 1 and Tier 2 payment rates will be reduced in two tranches as follows:

The payment rates apply to all individuals eligible for JobKeeper payments — i.e. eligible employees, eligible business participants and eligible religious practitioners.

The employer’s obligations

The employer must:

- notify the Commissioner of the payment rate that applies to each individual; and

- other than a sole trader — notify the individual of the payment rate within seven days of notifying the Commissioner.

Employer’s who have already received JobKeeper payments under the original scheme do not need to re-elect into the extended schemes if they qualify for payments under the extended schemes.

Furthermore, employers who did not participate in the original JobKeeper scheme can still qualify for the extended schemes provided eligibility criteria are satisfied.

New actual decline in turnover test

From September 28, business’s will need to apply a new actual decline in turnover test in addition to the existing decline in turnover test.

The new ‘actual decline in turnover test’ will operate as follows.

- Extension 1 (28 September 2020 – 3 January 2021) will require a business to compare current GST turnover for the September 2020 quarter to GST turnover in the September 2019 quarter.

- Extension 2 (4 January 2021 to 28 March 2021) will require a business to compare current GST turnover for the December 2020 quarter to GST turnover in the December 2019 quarter.

Provided that turnover has dropped by the relevant amount (either 30% or 50%) when comparing the periods above, then the business will qualify for JobKeeper under the extended schemes.